Bank-to-Bank Payments

Bank-to-Bank payments are a new payment method, fully backed by the bigest banks in the UK.

They offer lower rates, faster transfer of funds and lower fraud risk than credit cards, with no chargebacks.

Bank-to-Bank payments

Bank-to-Bank payments are a new payment method introduced by the UK's biggest banks in the last 4 years (you'll sometimes hear them referred to as "Open Banking PISP Payments")

Bank-to-Bank allows a merchant (you) to instruct the customer's bank to start a payment into your bank account; once the customer has securely authorised the payment using their bank's digital banking application, their bank handles the transaction immediately.

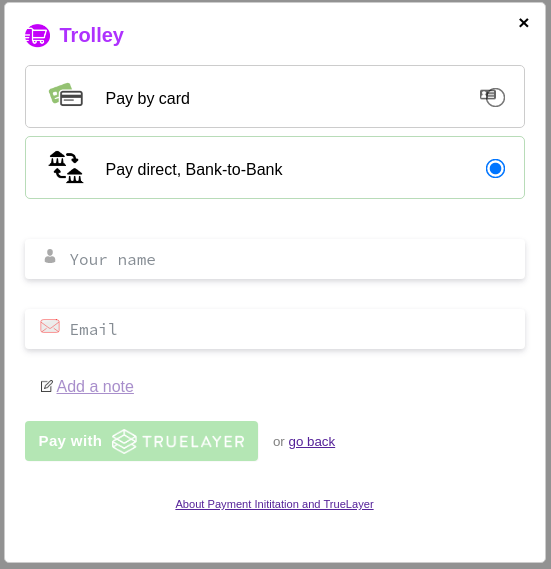

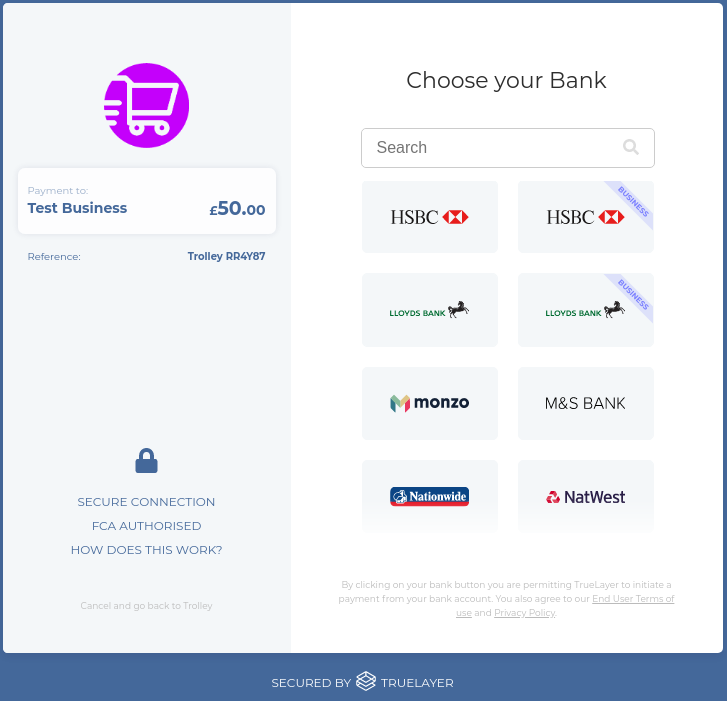

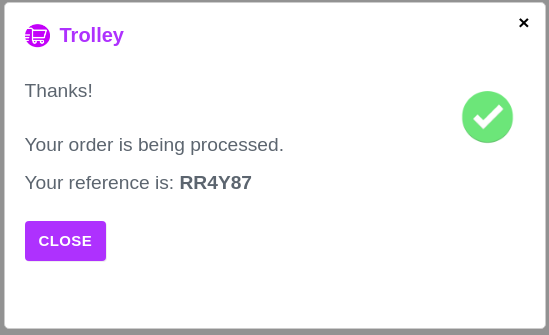

What the customer sees

From a customer perspective, the magic behind the scenes is invisible.

They see an optimised and easy-to-use payment flow that offers the choice of credit card or Bank-to-Bank payment, lets them select their bank, and guides them through agreeing to the payment.

⇨

⇨

⇨

⇨

The benefits

The benefits of Bank-to-Bank payments are very clear.

- Immediate settlement - your moey arrives in minutes, not after several days as it does with credit card payments

- No chargebacks: the banks and your customers assume responsibility for transactions, meaning the credit card provider can't take your money away from you later

- More secure - no credit card details to exchange or worry about

- Simpler fee structures - there's no interchange, no scheme fee, no confusing terminology - and fewer middlemen

- Lower rates than credit card payments

- Low fraud. The banks secure and verify transactions, and as a result fraud risks are very low.

How to get Bank-to-Bank in Trolley

It's really simple - all you have to do is click the "Get Bank-to-Bank payments" button in your account dashboard.

That opens our application form, which asks a few simple questions about your business.

If you meet our qualifying criteria then we'll enable Bank-to-Bank payments on your account.

Then you can begin accepting payments via Bank-to-Bank.